by admin | Apr 7, 2022 | News and Updates, Tax

“Punish the rich” tax proposals never seem to go out of style—at least for the Democrats. In the 2020 Democratic presidential primaries, it was all the rage for Senators Elizabeth Warren and Bernie Sanders. But after they both failed in their White House bids, they decided to double down on their wealth tax with an ill-conceived proposal on Capitol Hill in early 2021.

So far nothing has come of that. But enter President Biden.

At the end of March, Biden unveiled his Billionaire Minimum Income Tax proposal, and it’s every bit the disaster that you would imagine it to be. The plan would tax the appreciation of financial and business assets worth more than $100 million. (That’s not exactly a billion in net worth, but math has never been a strength for the Democratic party.)

So, how would it work?

Biden’s proposal would require taxpayers who are worth more than $100 million to pay a minimum of 20% on their capital gains each year, whether they sold the assets for a profit or continue to hold them. This would put a tax on unrealized gains, completely overhauling the current tax code which only taxes gains after they are realized (e.g. when someone gains a profit from selling a stock).

The idea is quickly gaining ground with most Democrats who believe that it could create hundreds of billions of dollars in new revenue over a decade. Of course, that’s just a small drop in the bucket for Biden’s $5.8 trillion budget proposal, which means, guess what? They’re still going to come after your dollars, middle class.

But don’t tell that to Arizona State University law professor Erin Scharff. She’d rather peddle this garbage on behalf of the president and push Congress to make these $100-million billionaires “pay their fair share.”

Unfortunately, Ms. Scharff doesn’t understand that most wealthy people will still figure out ways to avoid paying the tax—even if it is implemented. And if they do end up paying it, the results would likely add more damage to our economy.

But if Ms. Scharff can’t wrap her head around that, you would think that as a law professor, she could at least recognize that Biden’s Billionaire Minimum Income Tax—much like many of his plans—is likely illegal. Other similar taxes that have targeted wealth have been reviewed in the past, and this one likely runs afoul of the “direct tax” clause in the U.S. Constitution.

It’s pathetic that an ASU law professor is pushing a tax plan that is on extremely shaky legal ground, but this is the state of “higher education” in America.

Regardless of its legality, there is no doubt that—just like the original income tax—this new billionaire tax plan won’t just be a tax on the rich. As history has shown us time and time again, the appetite for more revenue never subsides in Washington, D.C. You can guarantee that this plan will eventually apply to everyone—no matter your income or your wealth. And that just goes to show you how this proposal by Biden—and pushed by this law professor—is completely out of touch with the issues affecting taxpayers. Inflation is out of control and supply chains are still a wreck, but for Democrats and ivory tower law professors, those issues are secondary to their ideological desires to redistribute wealth.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Mar 17, 2022 | News and Updates, Tax

The State of Arizona has great reason to celebrate. In a case that the Club joined as a plaintiff, Maricopa County Superior Court Judge John Hannah ruled against Prop 208, determining that the money raised from the tax would exceed the constitutional spending limit for education. This decision followed the Arizona Supreme Court’s ruling last August that Prop 208 was unconstitutional. And now, it officially puts the nail in the coffin of the largest tax hike in Arizona history.

This is great news for taxpayers throughout our state, except if you’re House Democrat Minority Leader Reginald Bolding apparently. But while Prop 208 may be dead, the fight is not quite over yet.

For years, teachers’ unions and out-of-state special interest groups led by the National Education Association (NEA) and Stand for Children have been trying to push this $1 billion tax hike on the backs of Arizona’s small businesses. And they’ve spent over $40 million trying to make that happen. That’s right. Over $40 million with nothing to show for it.

But Red4Ed and the rest of the backers of Prop 208 won’t give up. After the Supreme Court struck down their unconstitutional tax hike, they moved to target the $1.8 billion tax cut that would establish a flat tax and provide a tax cut for all Arizonans. Back in October, Invest in Arizona, a political committee sponsored by the Arizona Education Association and Stand for Children, submitted a referendum to put the historic tax cuts on the ballot for voters to decide its fate. Thankfully, the Invest in Arizona ballot referendum to overturn SB1783, which was passed to give tax relief to small business owners in our state, failed signature review.

And while they want you to believe that the referendum was a “citizen led grassroots effort,” their campaign finance report tells us otherwise. The NEA and Stand for Children dumped in more than $4.5 million to flood the streets with paid circulators to gather signatures for the referendum. (That’s in addition to the $40 million we mentioned earlier). And when they realized that it was tough to get people to sign a referendum that would give them a tax cut, the circulators started lying to voters, telling prospective signers that the referendum would somehow stop K-12 funding cuts.

With Arizona sitting pretty with a $4 billion dollar surplus, it is absurd that these out-of-state special interests would be spending millions to block tax relief for Arizonans. But we also think their referendum is unconstitutional and lacks the requisite number of signatures to qualify for the ballot.

The bills being targeted by Invest in Arizona directly provide for the support and maintenance of our state. And the Arizona Constitution is clear that issues related to the support and maintenance of the state government cannot be referred to the ballot. It was also clear after our signature review of the referendum that over half their signatures were invalid or were gathered fraudulently by the circulator mercenaries that they hired.

That’s why the Club filed a lawsuit against Invest in Arizona’s tax cut referendums. While we’re still waiting for a decision from the Maricopa County Superior Court, there’s a good chance that this will wind up at the Arizona Supreme Court just like Prop 208. And let’s hope they rule the same way.

Arizona is already spending a record amount of money on K-12 education. And the tax cuts Republicans delivered back in July still allowed for hundreds of millions in new funding for K-12 schools and universities. Now, it’s time to ensure that the people of Arizona get what they really need: tax cuts that put more of their hard-earned money back into their pockets.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Mar 10, 2022 | News and Updates, Tax

We tried to warn them. But Pinal County officials decided to move forward with their illegal and unconstitutional transportation tax anyway. Thankfully, on Tuesday, the Arizona Supreme Court issued a tremendous victory for Pinal County taxpayers and the rule of law.

And while it’s disappointing that taxpayers were forced to pay thousands of dollars to defend this illegal tax scheme in court, the Pinal County Board of Supervisors will now have to end the collection of this tax and issue refunds to aggrieved taxpayers.

A tax on retail sales below $10,000

This all started in 2016 when Pinal County officials began turning the political wheels to send a $640 million tax increase to voters to fund a wide array of transportation projects throughout the region. But after unveiling the plan, the effort quickly spurred opposition from retailers, home builders, auto dealers, and multiple taxpayer watchdog groups.

You would think that county officials would have taken this as a sign that the community didn’t support their proposal. But no. Instead, they developed a new plan to try to buy off their political opponents.

In order to eliminate opposition to their scheme from certain businesses, county officials added a special carve-out for purchases that exceeded $10,000 from paying the new tax. Interesting move, isn’t it?

But this meant that the new tax would apply only to retail sales below $10,000—making the day-to-day purchases of lower-income citizens more heavily taxed than more expensive items.

It also meant pushing a tax scheme that likely violated state law. County officials were aware that capping the tax at $10,000 wasn’t authorized by statute, which is why Pinal County introduced HB2156, legislation that was quickly killed by lawmakers.

A violation of Arizona law

Arizona’s tax laws are already some of the most confusing in the country, and Pinal County’s transportation tax only made that worse. If counties could be allowed to create new tax classifications in addition to the ones already established under state law, Arizona’s tax laws would become even more confusing with different taxes at different rates.

This is not what state lawmakers intended. County officials cannot be allowed to make their own rules. After all, this is the sort of thinking that pushes businesses out of our state and keeps new businesses from springing up inside our state. That’s why the Goldwater Institute challenged the Pinal County transportation tax in court. And the Club supported the effort every step of the way. Even the Arizona Department of Revenue sided with taxpayers on this one!

But Pinal County still tried to claim that it could subdivide the tax in this way because the law allows counties to set a “variable rate” in a tax, and that it was setting the “rate” of some sales at zero. Thankfully, the Arizona Supreme Court saw right through that argument, explaining that “In this case, Pinal County’s two-tiered tax rate structure—which established a positive tax rate and a tax rate of zero percent—sets fixed tax rates that never vary and are never subject to change.”

This is a big win for taxpayers in Pinal County and across Arizona. In the midst of a worsening economy, rising inflation, and near-record gas prices, our government should be seeking every way possible to put more money back into the pockets of its citizens. And if other counties are considering similar schemes, now a clear message has been sent.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Mar 8, 2022 | Corporate Welfare, News and Updates, Tax

Arizona lawmakers are currently living in “La La Land.” No, really. They want to dole out $150 million of your dollars to sign checks to woke Hollywood producers to literally California our Arizona.

SB1708, sponsored by Senator David Gowan, passed out of the Senate last week by a vote of 21-7. It provides a tax credit for a percentage of movie production costs: 15% for productions up to $10 million, 17.5% for productions between $10 and $35 million, 20% for productions over $35 million, and the opportunity for an extra 2.5% on top for positions held by Arizona residents, if the production is filmed in a qualified facility or primarily on location, or if it was produced in association with a long-term tenant in a qualified production facility.

The worst part—it’s refundable. This means that if Hollywood producers wipe out their tax liability to zero, the remaining tax credits come as a check from you, the taxpayer.

Movie production is a multi-billion-dollar industry. They do not need a subsidy. But because one state was willing to cut them a check a few decades ago, they now seek the highest bidder. It’s a race to the bottom for Arizona. Very soon, $150 million won’t be enough, and the industry will send more lobbyists down to the Capitol to razzle dazzle lawmakers into doling out more taxpayer dollars.

These production companies are more than able and happy to pick up and jet-set from one location another—even in the middle of production. If Arizona isn’t willing to pay more, another state or country will, and we’ll be left in the dust.

Georgia taxpayers gave the movie industry $1.2 billion last year. To keep up, California, home of actual Hollywood, is doubling its cap from $330 million a year to $660 million. Kevin Costner is currently lobbying the Utah legislature to provide a carveout in their $8.3 million cap for credits, raising it for movie productions in rural areas. Costner is telling Utah he wants to film 5 films there if the cap is raised. And star struck New Mexico recently more than doubled its cap, after spending hundreds of millions from their general fund to pay off a backlog of credits.

But while these states are fighting to out-bid each other, others have scrapped the idea. 13 states have eliminated their Hollywood subsidies in the past 10 years, and several others have scaled theirs back. And for good reason. A recent study of the subsidies in New York, Louisiana, Georgia, Connecticut and Massachusetts found that despite $10 billion in taxpayer dollars spent, there was no statistically significant impact on employment.

If this seems like such a bad idea that it should be illegal—it likely is. The Arizona Supreme Court recently ruled that the government cannot include “anticipated indirect benefits” such as projected sales and tax revenue as part of the consideration with a private party under the Gift Clause in the Arizona Constitution. In other words, Hollywood dazzling lawmakers with projected economic development leading to increased tax revenue is an “irrelevant indirect benefit” that cannot be included in the consideration.

In addition to the bill’s terrible tax policy and obvious unconstitutionality, Arizonans do not want their hard-earned dollars being used to send checks to Hollywood. We do not want to subsidize their woke movies, and do not want thousands of liberal California voters shipped into Arizona on our own dime.

Tell Your Lawmakers to OPPOSE SB1708!

Right now, lawmakers are considering a $150 million REFUNDABLE tax credit for woke Hollywood producers.

Arizonans have been shouting “Don’t California my Arizona” for years. But SB1708 pays to literally California our Arizona, shipping in thousands of Hollywood voters on the taxpayer’s dime. Regardless of the industry, Arizona taxpayers don’t want their hard-earned dollars going to corporate welfare with any refundable credit.

Send a message to Arizona lawmakers today and tell them Don’t California our Arizona: OPPOSE corporate welfare and OPPOSE SB1708!

by admin | Feb 3, 2022 | News and Updates, Tax

It’s not every day that one political party would seek to find a way to get more of its opponents to vote. But this is 2022, and apparently some Republican lawmakers just can’t help themselves.

Earlier this week, the Senate Transportation and Technology Committee unanimously approved SB1356. This bill is a tax increase that follows the expiring Proposition 400, a transportation tax of half a cent that was approved by voters in 2004. The plan itself is a complete boondoggle. If passed and signed into law, most of the money would go to transit and pet projects. (You can read more about that here.)

But one part of this bill is a total disaster. And anyone who considers themselves to be conservative should be outright concerned that Republican lawmakers not only approved the bill, but two of them actually sponsored it.

Buried inside SB1356 is language that attempts to rig the vote on this particular initiative. And that’s not the worst part. This language would also provide a big boost to Democrats in November.

But how?

First of all, the legislation prescribes (on pages 24-25) the exact ballot subject title and description, along with the language to describe the effects of both a “yes” vote and a “no” vote that will appear on the ballot. Normally, this would be drafted by attorneys or election officials not affiliated with the campaign. And while that certainly isn’t a perfect system, at least they are independent from the campaign and are required by law to draft impartial language. (This allows someone who believes that the language isn’t impartial to sue.)

But with SB1356, the supporters of the tax are the ones who drafted the language. And they did so using poll-tested and focus group language paid for with your tax dollars. In fact, they even included in the bill (on page 7) the ability to engage in an unlimited amount of polling—all at the expense of taxpayers like you. And because this language is included in the bill, there is no recourse for suing to ensure that it’s impartial.

If you think that is bad, we’re not done yet.

The legislation also provides unlimited funding through the roadway fund to Maricopa County to conduct the election for the tax. This includes funding for lawyers, consultants, employees, telecommunications costs, and canvassing for the election. So, basically, this bill is writing a blank check to Maricopa County to conduct a massive, taxpayer funded “Get Out the Vote” campaign to drive supporters of the tax to the polls.

And who do you think the supporters of such a tax will be?

Democrats.

That’s right. The Republican legislature is thinking about including a measure on the November 2022 ballot that is specifically designed to garner Democrat support. And less than a year after the state legislature banned Zuck bucks from influencing Arizona’s elections, some are apparently ok with a rigged election and making taxpayers foot the bill for a campaign that will increase Democrat turnout.

Clearly, this isn’t a plan to build roads and freeways—or improve how we move people from point A to point B. And this sort of bill is certainly not why you voted for a Republican legislature. Now, they need to do the right thing and vote NO on this so-called “transportation” bill.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Dec 21, 2021 | News and Updates, Tax

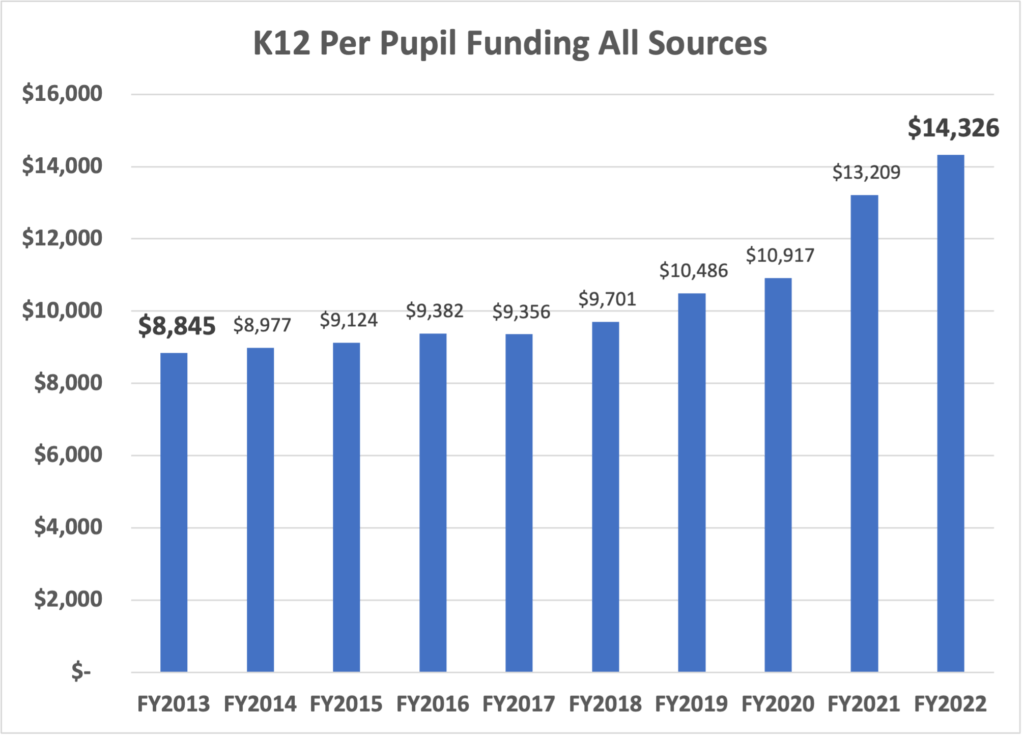

If you have been listening to the left and their friends in the media over the last several years, you might be under the impression that conservatives in the legislature have chronically underfunded K-12 education. But this couldn’t be further from the truth, and the truly historic levels of education funding actually threatens their soak the rich tax hike (Prop 208).

The reason we know K-12 is funded at historic levels is because there is a constitutional expenditure limit. Next year, we’re on track to blast above it. By billions.

Their pivot has been to attack the expenditure limit, as opposed to acknowledging how much the state is spending. But taxpayers should be thankful for this constitutional protection. It isn’t outdated, and it isn’t holding our schools back.

In 1980, Arizona voters approved the limit. It isn’t some subjective cap that legislators can manipulate to cover up how much or how little is being spent. It’s an objective formula that bean counters at the Department of Revenue use to calculate the limit every year. Funding levels are calculated annually to include student population, plus inflation, plus an additional 10% is added on top. For this year, that amounts to just over $6 billion.

Oh, and did we mention that this funding cap doesn’t include certain revenue streams, as many sources of funding are exempt from the K-12 spending limitation? For example, all of the Covid $$ received from the federal government is exempt from the constitutional cap. The result is that the actual amount spent on K-12 in FY 2022 is $16.2 billion, or $3.4 billion more than the entire state budget.

Even adjusted for inflation, this amounts to the highest per pupil spending in state history.

The constitutional spending cap does allow for a one-time override, but that requires a vote of two thirds of the members of the legislature. That means we can expect early next year to see the education spending lobby, democrats, and the media beating the same K-12 drum that $14,326 per student is not enough.

They will tell the public that conservatives have chronically underfunded education and that they must override the expenditure limit or schools will be broke. But conservative lawmakers should stand firm, push back on the misinformation, and tell voters that the only reason we are having this debate is because the legislature has continued to pump record amounts of money into schools.

The expenditure limit ensures K-12 funding grows at a contained and reasonable rate, provides an objective measure on how much we spend, and, importantly, protects the pockets of taxpayers from being robbed to flood schools with cash. Arizona taxpayers should be grateful that this constitutional protection exists and should tell lawmakers to say no to any reckless expenditure override.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

Recent Comments