After raking in cash from taxpayers amounting to a staggering $4 billion surplus, Governor Ducey and Republican legislators have delivered big with a historic tax cut this year. At full implementation, the cuts enshrined in SB1827, SB1828, and SB1783 will total $1.8 billion, and this couldn’t have come at a better time.

While Arizona families and small businesses were struggling during covid shutdowns and trying to make ends meet, the tax collector was still busy collecting. And as all Arizonans were already being overtaxed, on the narrowest margin, Proposition 208 was passed threatening a 77% tax hike on many Arizonans and small businesses. The tax cuts in this year’s budget completely neutralize that threat.

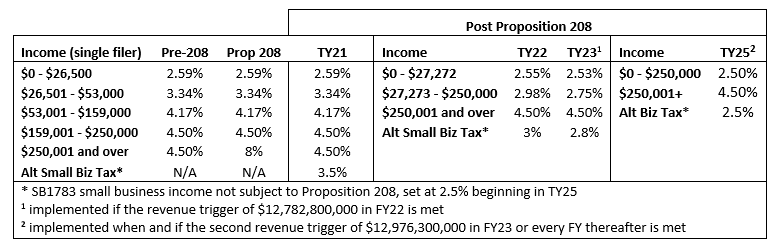

The tax cut package will result in a tax cut for all Arizona taxpayers. At full implementation, the current four rates of 2.59%, 3.34%, 4.17%, and 4.5% (with a fifth Prop 208 rate of 8%) will be collapsed into one single rate of 2.5%.

But since Proposition 208 is voter protected, income above $250,000 ($500,000 for married filing jointly) would still be hit with the 3.5% “surcharge,” resulting in a top rate of 6%, leaving Arizona still uncompetitive. The tax cut package takes care of this, too, by capping the top rate any taxpayer will shoulder at 4.5%, or the current top marginal rate.

Finally, holding the Red4Ed Prop 208 proponents to the promise that their tax hike “legally” could not affect small businesses, SB1783 will create an optional alternative small business tax which will have a rate beginning at 3.5% this year, ratcheting down to match the new single individual income rate of 2.5%. This means that small businesses can bifurcate their business income from their personal income, filing it under the alternative small business tax and paying a rate of 2.5% instead of the capped 4.5% rate. To reiterate, this is small business income that by Prop 208 advocates own words was never supposed to be subject to the surcharge. SB1783 codifies that intent.

This is big, and it will ensure Arizonans can enjoy continued economic growth. After the passage of Prop 208, Arizona was facing a 10-year economic impact of at minimum $2.4 billion in lost revenue and 124,000 jobs. Not anymore. This package not only mitigates that bleak future, it reverses the trend, creating a better tax environment than before.

As residents of high tax states continue to flee from income persecution in states like California, New York, and Illinois to seek shelter in low tax Red states, this tax cut package will ensure entrepreneurs, business owners, and families have Arizona high on their list. These tax cuts alone instantly take Arizona from ranking 13th in economic outlook (the worst Arizona has ever received) to 3rd.

And to the contrary of the alarmists decrying a tax cut for everyone as “welfare for the wealthy,” conservative leaders were able to pass this historic $1.8 billion tax cut while spending a record high amount for education with hundreds of millions in new funding for k-12 and universities, paying down over a billion in debt, and spending hundreds of millions on infrastructure. All while maintaining a billion-dollar rainy day fund and a half billion-dollar structural balance.

As Senator Mesnard, the bill sponsor of SB1783 said in his vote explanation, when the state experiences a surplus as a result of this tax cut deal, let’s remember this day. It’s a day worth celebrating.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

Recent Comments