by admin | Mar 17, 2022 | News and Updates, Tax

The State of Arizona has great reason to celebrate. In a case that the Club joined as a plaintiff, Maricopa County Superior Court Judge John Hannah ruled against Prop 208, determining that the money raised from the tax would exceed the constitutional spending limit for education. This decision followed the Arizona Supreme Court’s ruling last August that Prop 208 was unconstitutional. And now, it officially puts the nail in the coffin of the largest tax hike in Arizona history.

This is great news for taxpayers throughout our state, except if you’re House Democrat Minority Leader Reginald Bolding apparently. But while Prop 208 may be dead, the fight is not quite over yet.

For years, teachers’ unions and out-of-state special interest groups led by the National Education Association (NEA) and Stand for Children have been trying to push this $1 billion tax hike on the backs of Arizona’s small businesses. And they’ve spent over $40 million trying to make that happen. That’s right. Over $40 million with nothing to show for it.

But Red4Ed and the rest of the backers of Prop 208 won’t give up. After the Supreme Court struck down their unconstitutional tax hike, they moved to target the $1.8 billion tax cut that would establish a flat tax and provide a tax cut for all Arizonans. Back in October, Invest in Arizona, a political committee sponsored by the Arizona Education Association and Stand for Children, submitted a referendum to put the historic tax cuts on the ballot for voters to decide its fate. Thankfully, the Invest in Arizona ballot referendum to overturn SB1783, which was passed to give tax relief to small business owners in our state, failed signature review.

And while they want you to believe that the referendum was a “citizen led grassroots effort,” their campaign finance report tells us otherwise. The NEA and Stand for Children dumped in more than $4.5 million to flood the streets with paid circulators to gather signatures for the referendum. (That’s in addition to the $40 million we mentioned earlier). And when they realized that it was tough to get people to sign a referendum that would give them a tax cut, the circulators started lying to voters, telling prospective signers that the referendum would somehow stop K-12 funding cuts.

With Arizona sitting pretty with a $4 billion dollar surplus, it is absurd that these out-of-state special interests would be spending millions to block tax relief for Arizonans. But we also think their referendum is unconstitutional and lacks the requisite number of signatures to qualify for the ballot.

The bills being targeted by Invest in Arizona directly provide for the support and maintenance of our state. And the Arizona Constitution is clear that issues related to the support and maintenance of the state government cannot be referred to the ballot. It was also clear after our signature review of the referendum that over half their signatures were invalid or were gathered fraudulently by the circulator mercenaries that they hired.

That’s why the Club filed a lawsuit against Invest in Arizona’s tax cut referendums. While we’re still waiting for a decision from the Maricopa County Superior Court, there’s a good chance that this will wind up at the Arizona Supreme Court just like Prop 208. And let’s hope they rule the same way.

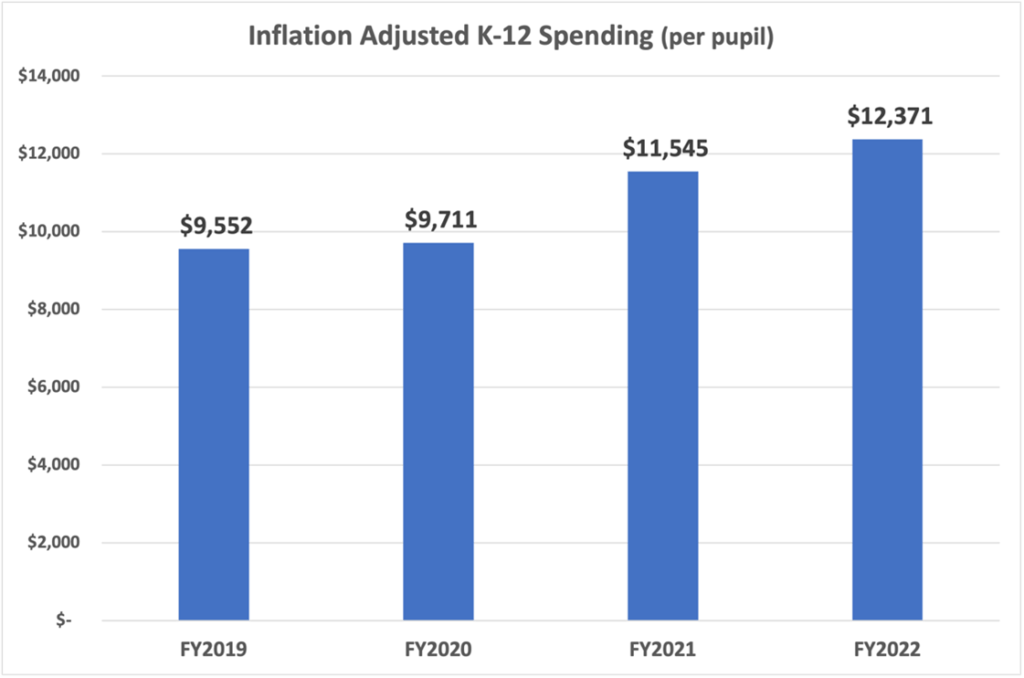

Arizona is already spending a record amount of money on K-12 education. And the tax cuts Republicans delivered back in July still allowed for hundreds of millions in new funding for K-12 schools and universities. Now, it’s time to ensure that the people of Arizona get what they really need: tax cuts that put more of their hard-earned money back into their pockets.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Oct 7, 2021 | News and Updates, Tax

Arizona taxpayers have had good reason to celebrate over the past few months. Not only did Republicans deliver historic tax cuts earlier this year, but the Arizona Supreme Court ruled that Prop 208 is unconstitutional.

This should be a time of rejoicing for the people of Arizona who will get some much-needed relief while still trying to recover from COVID shutdowns.

But the backers of Prop 208 won’t give up. They are angry and upset that their unconstitutional tax hike was struck down. Now, their latest move is to target the $1.8 billion tax cut that would establish a flat tax and provide a tax cut to all Arizonans.

Last week, Invest in Arizona, a political committee sponsored by the Arizona Education Association and Stand for Children, submitted a referendum to put the historic tax cuts on the ballot for voters to decide its fate.

And not surprisingly, this effort has a few similarities to last year’s Prop 208 campaign.

Let’s start with the signature collection effort, which was bought and paid for by the teachers’ union and Stand for Children. During the final weeks of their signature collection campaign, these two special interest groups flooded the streets with hundreds of paid circulators in an attempt to buy their way onto the ballot. In total, they employed 619 paid circulators, many of which likely have criminal records and were not properly registered with the Secretary of State.

Then, there’s the lies.

In the case of Prop 208, voters were consistently lied to about how the tax wouldn’t affect small businesses. But it did, which resulted in several small businesses leaving the state.

And the lies didn’t stop there. Prop 208 backers also said that the tax did not try to skirt the constitutional expenditure limitation. Thankfully, this lie ultimately doomed the measure in the Arizona Supreme Court.

Now, with this referendum, the lies continue.

Invest in Arizona is telling voters that the legislature cut education funding, which is blatantly false. Conservative leaders passed the historic $1.8 billion tax cut while spending a record high amount for education with hundreds of millions in new funding for K-12 and universities.

And to top it all off, Invest in Arizona is telling the people of Arizona that signing the referendum will restore over $1 billion in education funding. But this is a total lie! The referendum has nothing to do with education!

More than likely, this entire effort is just as unconstitutional as Prop 208. That’s why the Club filed a lawsuit challenging the legality of referring the tax cuts to the ballot. Right now, our case is currently awaiting a hearing in Superior Court, and we are optimistic that it has a high chance of success.

After all, Arizona Secretary of State Katie Hobbs has decided to remain neutral, despite being named in the lawsuit. And Attorney General Mark Brnovich field a motion for leave, along with an amicus brief urging the court to rule in our favor.

But regardless of what happens at the Superior Court, we are committed to pursuing our legal challenge all the way to the Arizona Supreme Court, if necessary. And as the process for reviewing the validity of the referendum signatures begins, you can rest assured knowing that the Club will be watching to ensure that all illegal and fraudulent signatures are removed from the petition total.

Invest in Arizona may not like it, but the people have already spoken. The tax reform package was voted on and approved by 90 lawmakers who were duly elected by the people of Arizona. And it was signed by Governor Ducey who was also duly elected by the people or Arizona. That means it should be here to stay.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Sep 2, 2021 | News and Updates, Tax

For over a decade, Arizona Democrats and the education lobby have been beating the same K-12 drum that our schools are underfunded, spending is at historic lows, and that the legislature refuses to invest more in K-12. And every establishment media outlet and so-called “investigative journalist” in Arizona have been more than happy to parrot this narrative for them. Most articles and opinion columns published by the Arizona Republic read more like repackaged press releases from the Arizona Education Association than anything resembling a real news story.

But unfortunately for the Democrats and their pals in the media, the recent Arizona Supreme Court decision on Prop 208 just blew their K-12 funding narrative into pieces. Under the court’s 6-1 decision, the majority ruled that any revenue generated from the Prop 208 income tax surcharge is not exempt from the constitutional K-12 expenditure cap, so if the tax hike would cause K-12 funding to exceed the cap, then the measure is unconstitutional.

This shouldn’t be a problem, right? According to the backers of Prop 208 and the Media, we haven’t been properly funding K-12 for decades.

Yet the lone dissent in the decision referred to the majority opinion as “almost certainly dooming the measure.” Dooming the measure? If Republican lawmakers have truly slashed education funding, if we haven’t been properly funding K-12 for decades, how could we be hitting a constitutional spending limit that hasn’t been reached since 2008?

That’s because everything the education establishment and the media has been telling you about K-12 funding levels in Arizona has been one big lie. Education spending in Arizona is at an all-time high, and we know this because we are hitting the K-12 constitutional spending cap.

The K-12 Constitutional Spending Cap Explained

In 1980, Arizona voters approved a series of constitutional tax and spending reforms at the ballot. These reforms were a bipartisan effort to address concerns of reckless spending and skyrocketing property tax increases throughout the state. One of those approved reforms was a limit on the amount K-12 school districts were allowed to spend.

This expenditure limitation is not determined by partisans at the legislature and cannot be manipulated so that politicians can hide how much funding they are providing to K-12. It’s an objective, formula-based spending cap calculated by nonpartisan bean counters on the Economic Estimates Commission consisting of a representative from the Department of Revenue and two other economists.

It’s calculated like this: the Commission takes the funding baseline from the 1979-1980 budget year, adjusts it every year for both student population growth and inflation, and then adds an additional 10% on top. In other words, the spending cap has been allowed to grow annually for 40 years to include both population growth and inflation, plus an additional 10%.

Additionally, this cap doesn’t include multiple funding sources that have been exempted from the cap. For example, the hundreds of millions coming from the Federal Government through the Covid spending packages do not apply toward the expenditure limitation. So when the cap is reached, Arizona taxpayers will know—based on an objective measurement—that K-12 spending is at a historic high.

The Economic Estimates Commission estimates that the education spending cap for FY 2022 will be just over $6 billion. Based on the recently enacted budget, we anticipate that Arizona will exceed the cap, which is why we expect Prop 208 to be ruled unconstitutional and struck down later this year.

Some may be asking: did the backers of Prop 208 know that their measure may trigger the education spending cap, thus tossing their measure into legal jeopardy? Perhaps they were believing their own press clippings about schools being underfunded?

This is the part that should make taxpayers’ blood boil. Not only did the education lobby know that 208 would trigger the expenditure limitation, but snuck language into their ballot measure to sidestep the cap by calling the tax surcharge revenue a “grant.”

That’s right—while they were selling the public on the myth that schools are underfunded and that we need to tax the “rich”, their lawyers concocted a legal strategy to sell judges on the idea that their tax is really a “grant” to avoid hitting a spending cap they knew we were going to hit.

Fortunately for taxpayers and small business owners, the Supreme Court saw through their scam and didn’t come up with some sort of John Roberts-style legal reasoning to save the measure.

One would hope that the education left would have learned a hard lesson from this blunder, but don’t count on it. Instead, their strategy seems to be gaslighting the public into thinking the expenditure limitation is archaic because it was set in 1980. Spreading falsehoods is almost second nature to them. Remember, these are the same people that claimed 208 wasn’t a tax on small business, yet have turned around and sued over SB 1783 because it might prevent small business owners from paying the 208 tax.

Until now the left has believed they can promote false narratives, with the help of the media, about K-12 funding and get away with it. Not anymore – the jig is up, and the lies have been exposed. K-12 funding is at record high levels and because of that, the Arizona Supreme Court decision will likely sink Prop 208 and take this narrative down with it.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Aug 26, 2021 | News and Updates, Tax

Last week brought some great news! In an opinion authored by Chief Justice Brutinel, the Arizona Supreme Court ruled that Proposition 208 is unconstitutional and remanded the case back to the trial court.

Now, it’s up to that court to determine whether the constitutional Education Expenditure Limit will be exceeded with Prop 208 monies. And with our state spending a record amount on K-12 education, we are nearly hitting it already—even without Prop 208 dollars.

This billion-dollar tax hike placed on the backs of Arizona’s small businesses will push us over. And that means the trial court must rule that Prop 208 is unconstitutional, killing it once and for all.

This is a big win for the State of Arizona and its taxpayers.

For months on end, Prop 208 voters were deceived. Every major funder, advocate, and organization behind the ill-conceived ballot initiative pushed the same narrative. They said that Prop 208 wouldn’t affect the Arizona economy or small businesses.

But with the passage of this disastrous piece of legislation, our state’s tax rate was raised dramatically to 8%, giving Arizona the ninth highest small business tax rate in the nation.

This wasn’t exactly the kick-off to the new year that small businesses were hoping for. And it even led some businesses—like Landmark Recovery which had been headquartered in Scottsdale—to leave the state.

But Prop 208 is now on its death bed. And once it’s officially struck down, Arizona’s economy will have dodged a bullet.

Of course, the Prop 208 crowd hasn’t given up. They are still actively collecting signatures on referendums to stop the historic tax reforms delivered by Arizona Republicans and signed by Governor Ducey at the end of June. And Invest in Arizona, a political committee sponsored by Arizona Education Association and Stand for Children, even filed a lawsuit against SB1783, which was passed to give tax relief to small business owners in our state.

Apparently, they don’t like the idea of providing $1.8 billion in tax relief to the people of Arizona—or giving every Arizona taxpayer a cut.

But what groups like Invest in Arizona don’t understand is that our state is currently sitting pretty, thanks to a $4 billion surplus. And Arizona taxpayers deserve a break, which is why the Arizona Free Enterprise Club and the Goldwater Institute have asked to intervene in Invest in Arizona’s lawsuit.

And it’s also why The Club filed a lawsuit of our own last month against Invest in Arizona’s tax cut referendums.

The time to cut taxes is now. It is undeniable that small businesses were hit hardest by the COVID shutdowns. And many of them are still trying to dig themselves out of the wreckage.

Invest in Arizona and anyone else who was involved in drafting Prop 208 need to accept the fact that this initiative is unconstitutional. The Arizona Supreme Court recognized that last week. And now the trial courts should do the same.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

by admin | Jan 25, 2021 | News and Updates, Tax

Do you remember when people were flocking to Arizona? When new employers, entrepreneurs, and families found our state attractive because of its low taxes?

It wasn’t that long ago. Here’s just one example from 2019, when the state’s top marginal tax rate was 4.50%— one of the most competitive in the country!

But all of that has changed thanks to Proposition 208.

With the passage of this disastrous piece of legislation in which voters were misled, Arizona’s new rate was raised dramatically to 8%. This gives Arizona the ninth highest small business tax rate in the nation! Of course, the teacher unions and out of state special interest groups behind Proposition 208 said this wouldn’t happen—that it would NOT tax small businesses. Clearly that was a lie.

And now, with Arizona already having the 11th highest sales tax rate and the 20th highest business property tax rate in the country, we are officially a high tax state for small business.

That’s not exactly something we’d want to advertise to those who may consider moving here. After all, a recent study from the Cato Institute found that American citizens are leaving high tax states for lower tax states. Certainly, that’s not much of a surprise. But Arizona used to be ones of the desirable states to move to because of its low taxes. Not anymore.

And while the media and the Left continue to push the myth that the people of Arizona are undertaxed, just ask small business owners their experience since Proposition 208 passed. If the taxes were so low, then why are many of them picking up and leaving the state?

The fact is that Arizona has now joined the ranks of other high tax states that have experienced decades of decline. You probably know some of them: Illinois, New York, California. Each of these states are dealing with high taxes, distressed economies, and people fleeing to other states to find greener pastures.

Just look at California, where an estimated 13,000 businesses left between 2009 and 2016. In fact, during the economic boom years in 2018 and 2019, 765 commercial facilities left the “Golden State.”

But this begs the question: If the economy was booming throughout the country, why did these businesses leave? The answer is quite simple: high taxes.

Is that what we want here in Arizona? We certainly hope not.

But thanks to Proposition 208, Arizona has now lost the tax-competitive advantage that once made it so special. And that means we can expect other nearby states like Nevada, Utah, Colorado, and Texas to have the upper hand when it comes to attracting small businesses and creating new jobs.

It’s time for our state legislature to take swift, aggressive action to fix this problem. Proposition 208 has made Arizona a high tax state, crushed small businesses, and done irreparable harm to the state’s competitiveness. And if our legislature doesn’t do something soon, we’ll end up in an endless cycle of decline—just like our neighbors in California.

You Can Make a Difference

If we don’t act soon, Arizona will soon look like other high tax states in rapid decline. Find out what you can do to undo the damage being caused by Proposition 208.

Recent Comments