Despite Halloween being long over, Katie Hobbs has decided to spend the Christmas season playing dress-up as a Trump-loving, tax-cutting, leader of the middle and working class.

On November 20th Governor Hobbs released her so-called “Tax Cuts for Middle-Class Arizonans” plan. If some of these concepts sound familiar, that’s because every single provision in her plan was word-for-word copied straight out of the One Big Beautiful Bill (OBBB) tax package signed into law by President Trump on July 4th:

- Increase the standard deduction from $15,000 to $15,750 for single filers, $31,500 for joint filers – straight from the One Big Beautiful Bill (OBBB)

- Adding an additional $6,000 deduction for seniors over 65 – straight from the OBBB

- Deducting tipped income from taxable income – straight from the OBBB

- Deducting overtime income – straight from the OBBB

- Deducting car-loan interest on new American-made vehicles – again, right out of the OBBB

So, after spending months opposing the OBBB, trashing Congressional Republicans and urging its defeat, Hobbs has now decided to pretend that it was her idea all along. It’s like she decided to wear a Dollar Store knockoff mask of President Trump, hoping no one would notice it said Made in MAGAland on the tag.

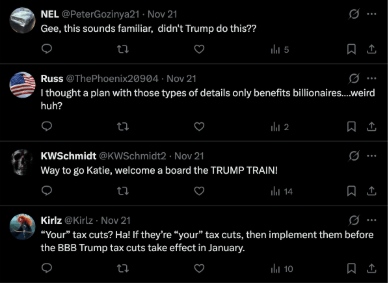

The social media reaction to her clumsy and desperate attempt to steal President Trump’s tax plan went about as one would expect. Hobbs was brutally ratioed by comments pointing out the obvious – Trump did this first, and better.

The traditional corporate media didn’t do her any favors either, grilling her about her plan’s lack of authenticity and how she now appears to be a flip-flopper on the OBBB. Suffice to say, if Hobbs was hoping for a glowing PR reception, her Trump tax plan heist landed with a thud.

School Choice Becomes Hostage of Plagiarized Tax Plan

Perhaps there are a handful of voters out there that do believe Hobbs had a change of heart and decided to jump on the Trump train for tax cuts. Could this be the start of a sincere effort to make Arizona more affordable for the middle class?

Unlikely.

Hobbs eliminated any perception of authenticity a couple weeks after her announcement when she undermined her own proposal by recasting it as a bargaining chip in her crusade against school choice funding. This proved that either she was never serious to begin with about providing tax relief to Arizonans, or she got so much backlash from her base that she “missed” an opportunity to use the tax conformity issue as political leverage that she felt it necessary to backpedal.

Either way, the tactic is doomed for several reasons. First, Republicans at the legislature won’t go for it. Second, there are no “savings” possible with ESA cuts without kicking thousands of children out of the program, which is both cruel and unnecessary. Any points Katie Hobbs scored via her plagiarized “middle-class family” tax relief plan has been undone by self-sabotage, now proposing hurting those same middle-class families by defunding their school choices.

Lastly, tax conformity is necessary (which is why she is responding to it) and has nothing practically or politically to do with school choice funding. Trying to tie the two together simply doesn’t work.

Not Conforming Will Lead to a Large Tax Increase

Unsurprisingly, Hobbs speaks “tax cuts” like it was a 3rd language. Complicating matters further is that her “plan” is actually part of a larger discussion about the need for the state to conform to the tax changes in the OBBB. Without a full conformity package, it is our position that Arizonans will be stuck with a tax increase north of $400 million dollars.

For those unfamiliar with tax conformity, Arizona’s tax code is “coupled” with the federal one. That means the state bases its definitions on things like adjusted gross income, deductions, and exemptions, on the federal tax code.

So, when Trump’s One Big Beautiful Bill delivered big tax cuts, Arizona lawmakers must pass conformity legislation to match those changes. If they don’t, Arizona taxpayers don’t get those same breaks – meaning their taxable income goes up, and they pay more in state income taxes – offsetting the benefit on the federal side.

To use Hobbs’ example of a server named “Sally”:

Sally earns $55,000 plus $5,000 in tips. Under Trump’s new law, those tips aren’t taxed, and the standard deduction increases to $15,750. But if Arizona doesn’t conform to the federal changes, Sally loses both benefits. Her taxable income jumps by $6,500 – and her state tax bill rises by about $150, even though she didn’t make a penny more.

But the reality of Hobbs’ plan is far, far worse. The break-even amount is a $420M reduction in state revenues; her plan will lead to a massive tax hike as it only adds up to $215M. Maybe Hobbs’ tax hike parading around as a tax cut is just that Orwellian thing Democrats do when they use language to describe the opposite of what they are really doing.

Leader? Not in the Governor’s Tower.

The most absurd part of this whole stunt is Hobbs trying to frame herself as a leader on tax relief. On the policy she is nothing but an imitator. And politically, she would be a leader, if only anyone was following her.

When Hobbs rolled out her plan, the silence from the Left was deafening.

No press conferences flanked by Democratic legislators. No love from “local” progressive bastions like Progress Arizona, the AEA or other Arabella Advisers-connected AZ groups. Not even a blip in one of the lefty-controlled narrative-spinning outlets like Copper Courier or AZ Mirror.

The traditional business community had nothing to say about her announcement either. Not even liberal leaning business groups like Greater Phoenix Leadership threw a bone to Hobbs. That’s because she is entirely out on a limb, too weak to muscle her way with Republicans, and too unpopular with even her own side to build a coalition around her.

And now she’s “calling on the Republican Legislature to follow her lead”? Please.

Who’s Really Leading on Tax Cuts & Affordability?

Our organization has long been preparing a real conformity package, one that actually delivers relief to working families and small businesses.

Here’s what a serious plan looks like:

- Fully covers the conformity “box” (roughly $420 million), so Arizona taxpayers see the full federal benefit.

- Includes all the accounting provisions in the OBBB that help small businesses such as full expensing for business property, increasing small business expensing from $1.25M to $2.5M, and 100% depreciation for business property.

- Is broad-based relief, not narrow carveouts.

- Prioritizes workers, families, and small businesses.

- Avoids bad policy gimmicks like the SALT deduction.

Republicans will likely fast track a more robust tax package on Hobbs’ desk in January, meanwhile (if she can even find a sponsor) her proposal will be lucky to get a committee assignment.

Republicans Will Ultimately Deliver – What Will Katie Do?

Just as Trump has been leading nationally on tax cuts and affordability, Arizona State Republican lawmakers will too. Because that’s what they have been doing the last three years – Hobbs has just been too busy either vetoing tax cuts or illegally trying to take credit for them.

Meanwhile Katie Hobbs’ “tax cut” plan is like her leadership, strictly performative. She isn’t fighting for taxpayers; she’s desperately trying to run in front of the Trump Tax Cut Train to avoid getting run over by it. But given how unconvincing even her tax cut theater is, her lack of original thought, and her inability to amass an iota of support, she’s better off surrendering to legislative Republicans and moving on.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

Recent Comments