After several years of inflated budgets propped up by trillions in unsustainable COVID cash flowing to the states from the federal government, Arizona lawmakers will be coming into the new year and the new legislative session facing a potential shortfall for the budget year in excess of $400 million. Naturally, the left and their sycophants in the media have for months been decrying this to be the result of 1) historic tax cuts enacted by Republicans in 2021 and 2) the successful universal expansion of school choice in 2022. This couldn’t be further from the truth, and there are three key facts that need to be remembered when discussing the state budget and a potential funding gap.

1. The Shortfall Is a Fraction of the Arizona Budget, Nothing Like California’s Crisis

The projected $400 million shortfall represents less than 5% of the total state budget, which spends $17.8 billion this year. Far from catastrophic. Compare this to our neighbor California, facing a $68 billion dollar deficit (nearly four times the size of our entire budget), which represents 22% of their $308 billion bloated budget – up from less than $200 billion only four years ago.

Opposite to our approach, California has continuously increased taxes, having one of the highest income tax burdens in the country. They also don’t provide choice to parents and families to make educational decisions themselves. Surely, if Arizona taking less of the people’s hard-earned money and providing ESAs to all families is the cause of our small funding gap, California, doing the exact opposite, should place them in tip top shape, right?

2. State Revenues Continue to Rise, but Spending Does Too

Contrary to the wishes of the tax happy left, this small budget shortfall is not due to the historic tax cuts passed in 2021 that benefit every Arizonan either. The state is collecting more from taxpayers than it did in 2019, yet the income tax rate has effectively been cut in half. Part of that is due to the taxation of online sales. Initially sold to be an $85 million hit on taxpayers, it continues to bring in hundreds of millions more. The other more inconvenient reason for the left is the thousands fleeing high tax states like California to relocate themselves, their families, and their businesses here.

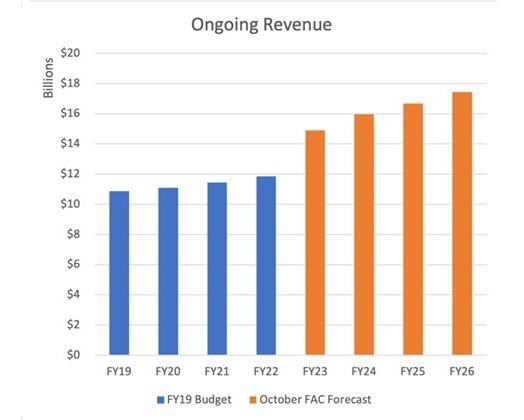

This “lack of money in the state coffers” argument is laughable with one quick look at the Ongoing Revenue chart. In summary, lawmakers enacted a budget in 2019 that expected just shy of $11 billion in ongoing revenue. In their best assessment, they expected that to grow to nearly $12 billion by FY22 (blue). But what we have experienced since then (orange) is exponential revenue growth – growth that is still continuing today. In fact, the most recent estimate from the nonpartisan Joint Legislative Budget Committee (JLBC) staff is still close to $18 billion in state revenue by 2026. We do not have a revenue problem, and we never did. Rather, we have had a spending problem for years.

3. School Choice Not to Blame, and Government Schools Are at Record Levels of Funding

Unsurprisingly, the teachers’ unions, Democrats, and media continue their scare tactics, arguing that the massive increase in families taking advantage of their right to send their kids to the schools of their choice, is bankrupting the state and government schools. It’s no surprise that neither are true.

As the Goldwater Institute has made clear, increased use of ESAs does not take from district schools. In fact, district schools are receiving $14,673 per student, an amount never reached before, which has required the legislature to override the constitutional spending limit not once, not twice, but three times, allowing schools to spend billions in excess of the cap.

That ESAs are to blame for the shortfall is also easily debunked by simply looking at JLBC’s presentation to the Finance Advisory Committee in October. In the budget approved by the legislature and the Governor, ESA expenditures were projected to be $625 million. The actual amount is $665 million, not very far off at all. In other words, the projections made by lawmakers in July were accurate and fully budgeted for.

Budgeting Guidelines to Avoid Fiscal Failures

The big picture is that states across the country are seeing slowdowns in revenue growth and potential shortfalls, especially in personal income tax collections. That includes states that have reduced rates (like us), and those that have hiked theirs (like California). But unlike many of those high tax states, Arizona is in a good position.

As long as the legislature: 1) doesn’t allow Hobbs to use any budget gimmicks like rollovers, 2) doesn’t touch the rainy-day fund, and 3) uses this as an opportunity to right size government spending, we will be just fine.

The good news is that based on the Senate Majority Plan released in December, they are committed to doing just this.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

Recent Comments