The Arizona state coffers are running over with cash. The state is set to receive $12B in federal recovery funds, more than the entire annual state budget. On top of that, forecasting by the Joint Legislative Budget Committee projects by 2024 the state will have a $6.4B cash balance with $1.5B in ongoing revenues. Republicans in the Legislature and Governor Ducey are looking to return the record high, multi-billion-dollar state surplus to taxpayers by passing major tax cuts.

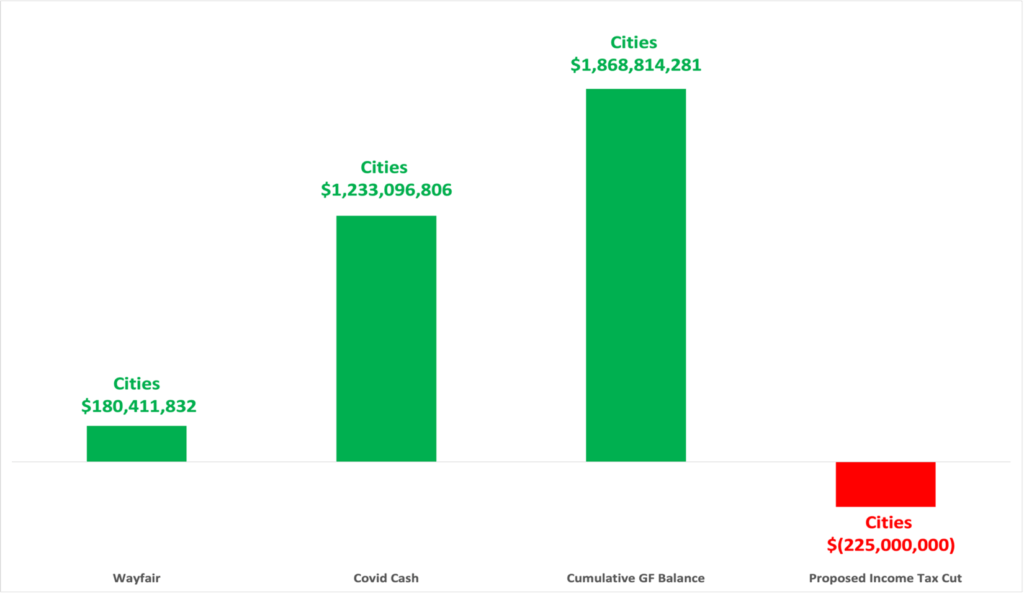

On the front lines to defeat these efforts—the cities—that are claiming major income tax reductions will significantly impact their bottom line. But it isn’t just the state sitting comfortably on a mountain of cash, the cities are too.

In opposing the proposed tax cuts, cities are arguing that the package will result in a $225 million decrease in their shared revenue from income tax collections. Despite this estimate being seriously flawed, their projections are in reality insignificant.

Based on research from the Arizona Tax Research Association, we’ll look at 4 cities—urban, rural, small, and large—comparing their estimated “cut” from the tax package to their cash balances and scored against additional revenues generated from the 2019 Wayfair legislation, which permanently expanded the cities’ tax base.

Chandler

The city of Chandler has a budget of just under $317 million in general fund expenditures for FY2021, leaving nearly $135 million in the general fund.

So far in FY2021, the city has collected close to $3.6 million in new, local TPT revenue and $1.2 million in state shared TPT collections by remote sellers. Taking the average from the 8 months of collections so far in FY2021, this would result in just over $7 million annually.

The estimate of Chandler’s decrease in shared revenue? Just over $10 million.

With a cash balance of $135 million, $7 million in new revenue from Wayfair, Prop 207 revenue, and nearly $36 million in Covid cash from the latest package, residents of Chandler need not worry about their city providing a high level of service.

Their estimated “cut” represents a 0.67% decrease in Chandler’s general fund when scored against new ongoing tax revenues.

Flagstaff

The city of Flagstaff budgeted $81.7 million in general fund expenditures for FY2021, leaving the city with a cash balance of over $33 million.

From Wayfair, Flagstaff has already collected $1.3 million from remote sellers and their estimated state share is $340,000. Averaged out this is just under $2.5 million in new annual revenue. Flagstaff has also received $15.2 million in new Covid cash.

The estimated “cut” from income tax reductions? $2.9 million. This represents a mere 0.36% decrease in the general fund when scored against new ongoing tax revenues.

Tucson

The city of Tucson has an FY2021 budget consisting of just under $517 million in general fund expenditures and has a $150 million cash balance.

From Wayfair, Tucson has collected $8.6 million during the first 8 months of FY2021 and the city’s share of state collections is estimated to be $2.5 million so far. Annually this could amount to $16.7 million. Tucson’s share of the latest Covid relief package: $139.7 million.

Tucson’s estimated reduction from income tax cuts is $21.3 million, or a 0.71% decrease in the general fund.

Eloy

The city of Eloy’s FY2021 budget includes $13.6 million in general fund spending. Interestingly, that leaves the city with a general fund balance of $15.2 million—more than their entire budget.

From Wayfair, Eloy has collected $173,477 year to date and their share of state collections is $88,727. Annually this could mean $393,306 in revenue for the city. Eloy is set to receive $4.7 million in Covid cash.

The estimated decrease that Eloy would see is $761,689.72, which would be 1.3% of the general fund.

Cities in Arizona are not strapped for cash.

In reality, most cities won’t feel much of a change at all from the small reduction in shared revenue from major state income tax cuts. But taxpayers will. The fact that the state and cities are sitting on ample cash reserves proves one fact. Taxpayers are overpaying in taxes. And returning some of their hard-earned money is long overdue.

Help Protect Freedom in Arizona by Joining Our Grassroots Network

Arizona needs to have a unified voice promoting economic freedom and prosperity, and the Free Enterprise Club is committed to making that happen. But we can’t do it alone. We need YOU!

Join our FREE Grassroots Action List to stay up to date on the latest battles against big government and how YOU can help influence crucial bills at the Arizona State Legislature.

Recent Comments